how much taxes does illinois take out of paycheck

Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding. The average tax rate for taxpayers who earn over 1000000 is 331 percent.

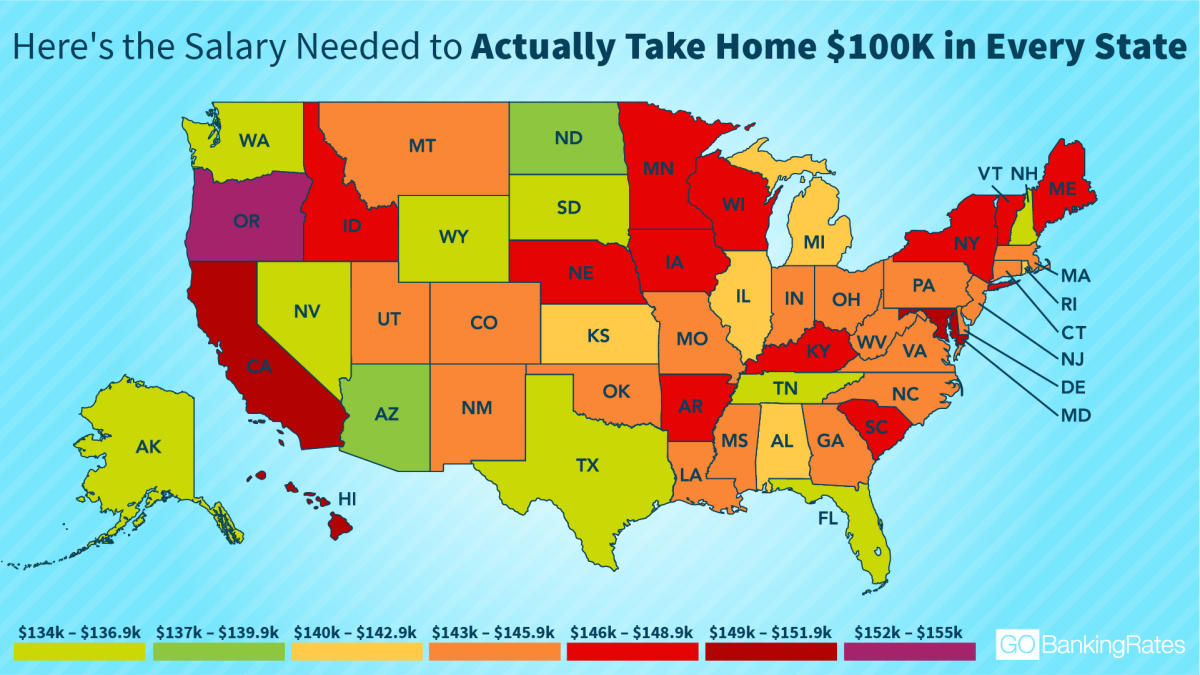

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live

As of January 1 2022 the Illinois unemployment tax rate ranges from 0725 to 7625.

. After a few seconds you will be provided with a full breakdown of the. Total income taxes paid. How much taxes is taken out of a paycheck in Illinois.

There is an Additional Medicare Tax of 09 percent withheld from employees paychecks if they earn more than 200000 annually regardless of their income tax filing. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124. You can even use historical tax years to figure out your total salary.

Newly registered businesses must register with IDES within. Rates are based on several factors including your industry and the amount of previous benefits paid. Personal income tax and unemployment tax.

The Illinois Paycheck Calculator uses Illinois tax tables and Federal Income Tax Rates for 2022. Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck. Amount taken out of an average biweekly paycheck. The wage base is 12960 for 2022 and rates range from 0725 to 7625.

For those who make between 10000 and 20000 the average total tax rate is 04 percent. To use our Illinois Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

Personal income tax in Illinois is a flat. Payroll taxes in Illinois. If youre a new employer your rate is 353.

So the tax year 2022 will start from July 01 2021 to June 30 2022. Just enter the wages tax withholdings and other information required. Calculating your Illinois state income tax is similar to the steps we listed on our Federal paycheck calculator.

There are two state taxes to be aware of in Illinois. Personal income tax in Illinois is a flat 495 for 20221. Personal Income Tax in Illinois.

What percentage is taken out of paycheck taxes. Estates over that amount must file an Illinois. Illinois Hourly Paycheck Calculator.

New Tax Law Take Home Pay Calculator For 75 000 Salary

State Withholding Form H R Block

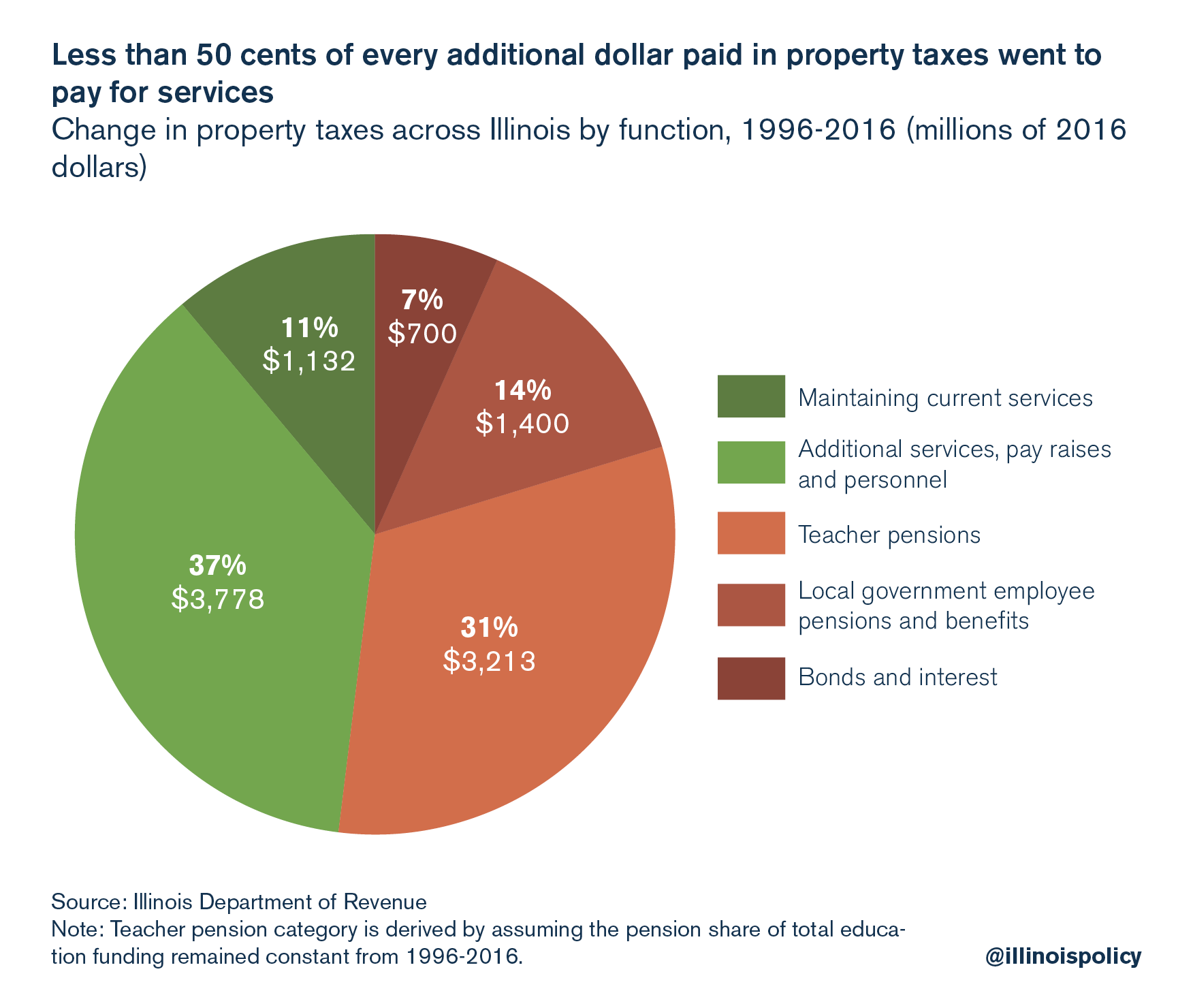

Study Illinois Property Taxes Still Second Highest In Nation

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

2022 Federal State Payroll Tax Rates For Employers

Illinois 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Here S How Much Money You Take Home From A 75 000 Salary

Millions Of Americans Could Be Stunned As Their Tax Refunds Shrink The Washington Post

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Illinois Hourly Paycheck Calculator Gusto

Will Illinois Eliminate Estate Tax In 2020 Foregoing Estate Taxes

Illinois Paycheck Calculator Adp

Illinois Tax Rebates Eder Casella Co Certified Public Accountants

New Tax Law Take Home Pay Calculator For 75 000 Salary

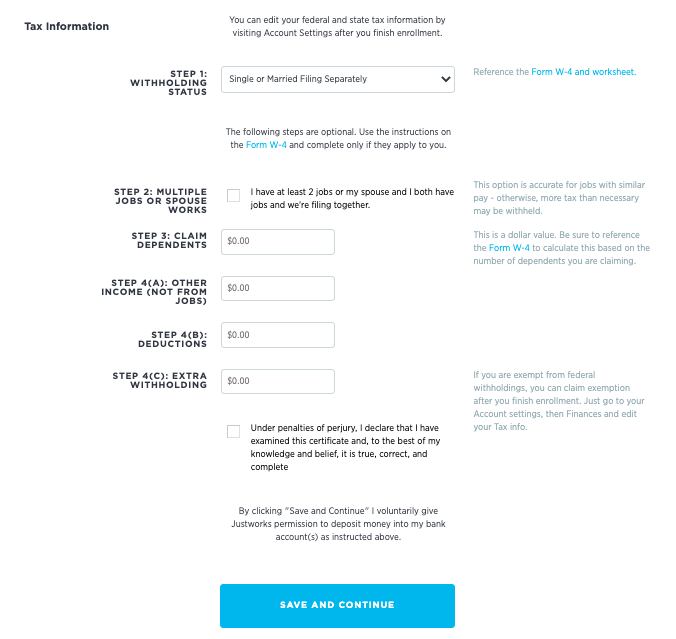

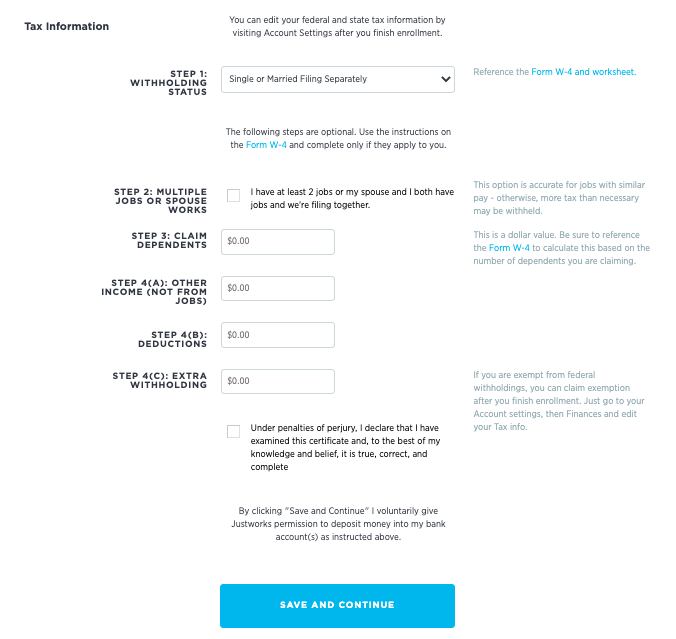

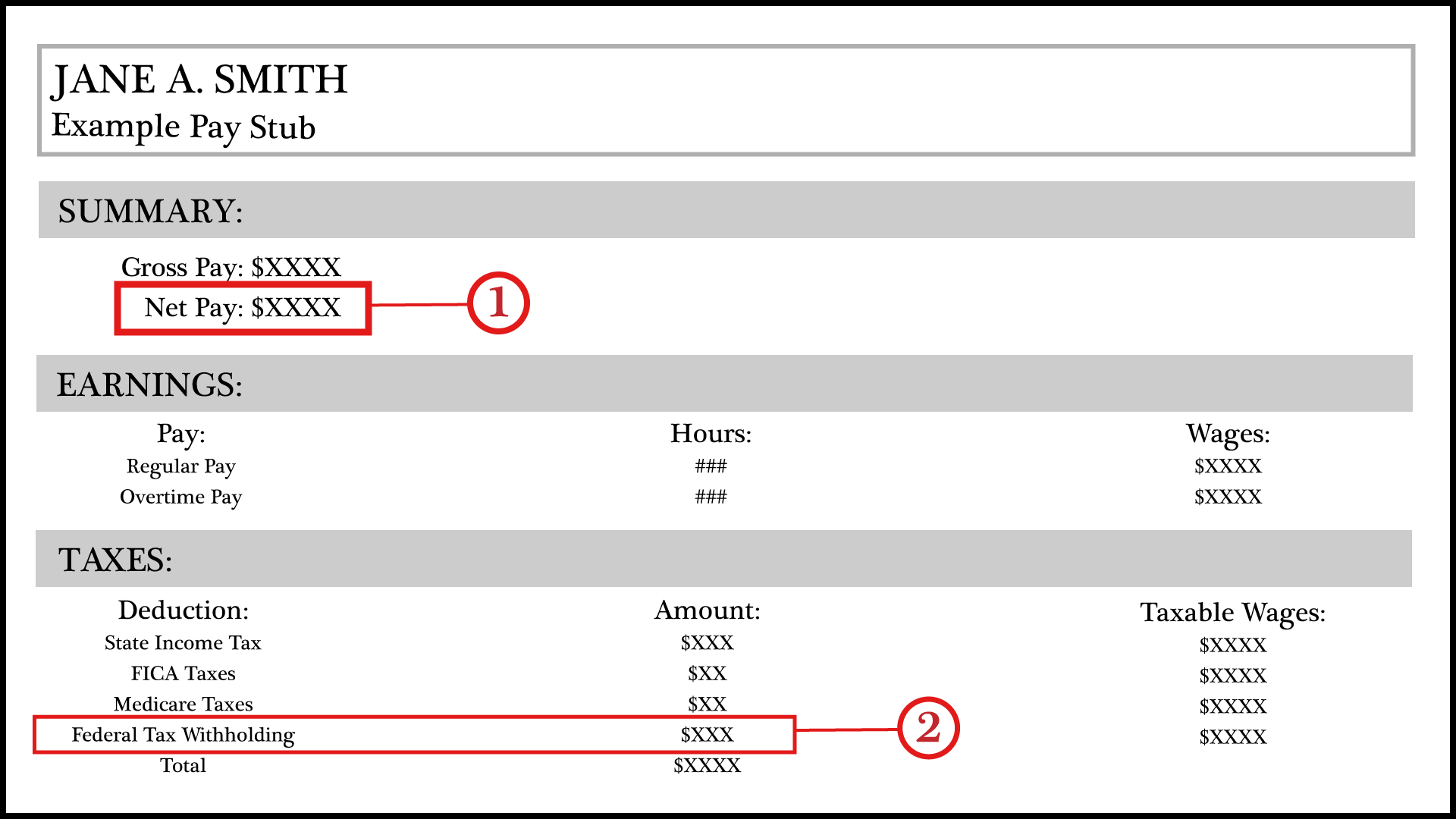

Questions About My Paycheck Justworks Help Center

Your Take Home Pay Gets A Boost This February Ways And Means Republicans

![]()

Free Hourly Payroll Calculator Hourly Paycheck Payroll Calculator

Illinois Paycheck Calculator Smartasset

This Is The Ideal Salary You Need To Take Home 100k In Your State